Immediate Costs and Future Costs.

The industry of test prep is huge, especially in some larger cities. Business, in the form of high-school students seeking academic help, is coming around all year long. Tests like ACT and SAT® are happening every 2 months. Parents are paying anywhere from $75 to a $1000 per hour for tutoring help.

Opponents of test prep industry argue that test scores do NOT represent student’s ability and level of achievement. Some opponents even say that standardized tests are becoming less and less important in the admissions process. Parents and kids are receiving mixed messages and becoming even more confused. In this article, we wanted to solve the mystery of how much poor ACT and SAT® scores are cosing a child and a parent in real dollars.

Whether standardized tests reflect your child’s ability to think and solve real life problem is irrelevant, because poor scores will affect your child’s future. Let’s analyze how much does it cost to neglect test prep and what consequences it can lead to, long — term and short — term.

We spoke with Lillian Luterman,an educational consultant in New York City, (entryway.com) who confirmed that ACT and SAT® scores are still important in the application process, even though an increasing number of schools have become test optional. She also mentioned that the Ivies (the Ivy League Schools) are NOT test optional. So if you are looking to enroll your child into Yale or Harvard (which we highly recommend, you’ll see why later), you will need to pay closer attention to test prep.

In 2016, colleges are relying on standardized test scores when making admissions decisions to a far larger degreethan they have in years. One reason is that the number of applications at most desirable colleges is soaring. That’s not because there are more 18 year-olds graduating from high school. It is because more kids are each applying to more colleges. College counselors recommend applying anywhere from 6 to10 schools at once. And with little increase in the size of admission staffs at most colleges, schools are using SAT® and ACT scores, along with GPA to make a fast, easy cut of the applicant pool. For MIT, for example, an ACT score of 33 or 34 along with great GPA will get your application looked at. If you scored below, your chances are slim to none.

But what if you are NOT looking to get into some super competitive schools? To get into a good college with an extensive alumni network, like Boston College, your child will need to get an average of 31–32 on the ACT, along with excellent grades (GPA).

Additionally, more and more students from overseas are joining the admissions pool. Ritu Shah-Asher, the Founder ofMyIvy Ally (myivyally.com) who specializesin placing international students into American colleges, told us that the number of Chinese and Indian students is rising every year. According to the WSJ article 304,040 new students came from China and 132888 from India in 2015. As China and India are raising the standards, even a 1 point difference makes or breaks the acceptance.

But what about the costs?

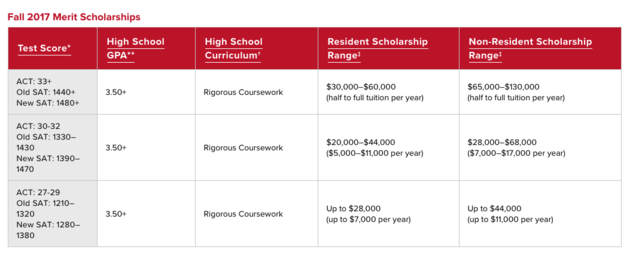

If your child scores poorly on a standardized test, it may translate into lower financial aid. To get more insights we spoke withAbby Siegel, an independent College Entrance Consultant (www.abbysiegel.com). She gave a great example of a merit scholarship from Miami University.

Given equal GPA (above 3.5) and rigorous coursework, "the amount of merit aid one could receive can be highly affected by the test score." The table above states that if you score 29 or below, your scholarship will max out at $7000 per year, and $30,000 total, while an ACT score of 33, will give you up to $60,000. That’s a $30,000 in hard cash for 4 points on ACT.

Along with financial remuneration, there is an additional benefit of higher test scores, which Abby Siegel mentioned. Higher test scores will increase your child’s chances of getting into the honors program. Here is how honors program works. Let’s say you wanted your child to have an experience of a big school, like Penn State, but also want them to study in small classes with best faculty, and get preferential treatment with registration and housing. Honors program is your answer. It’s the best of the two worlds, a big college experience with a small college treatment. How can your child get in? If the test scores are high, along with GPA, your child will be automatically considered for the honors program or there is a separate application for them to complete (in addition to the main application).

Getting your child into a better college, does not only mean better faculty, it also means surrounding your child with peers who have higher GPA and test scores. We chatted about those factors with a well-known psychotherapist, Marta Hatter from Revelation Counseling in California. “I have observed that young adults who have academic and personal growth goals are likely to achieve more goals and reach higher levels if they keep company with other highly motivated young adults. Like-minded people encourage and exhort one another in the direction of shared vision. There is a dynamic of accountability and reciprocity when goals and vision at hand are shared.”

There is a famous saying by Jim Phone:

“we are the average of five people you spend most of your time with.”

For many, college friends become life — long friends. It’s fascinating to think that standardized tests have a role in that!

Let’s go back to costs again.

Now you have graduated. If you had a lower financial aid (due to your lower test scores) you graduated with MORE DEBT! The conventional career advice is to get a low-paying job at a big firm right out of college and work hard, get great performance reviews and climb the ladder. Let’s say your entry-level job only gives you $30,000, but it sets you up for a $150,000 in 5–10 years. You can also take a higher paying job right out of college, say $45,000 a year, which will set you up for $85,000 in your prime. Which do you choose?

The first one of course! $150,000+ in 5 years will yield a higher return later on for a lot more years. Let’s do a quick dive in and do some math. Let’s say you took a low-paying job at Deloitte that pays $30,000. A basic budget for that $30,000-a-year earner would be tight. With a $345 monthly school loan payment, there would be just $626 a month for housing, $292 a month for food and $146 a month for household costs, which would include everything from laundry to Internet service. If you don’t have student loans or if the payment amount is minimal, you can take the $30 K job and grow to an executive role in the same company. Most students with higher debt amount have to choose a higher paycheck right away and sacrifice working for big-name firms right out of college.

Do Ivy League Graduates make more MONEY?

Since none of our sources could answer this questions, we decided to Google it.

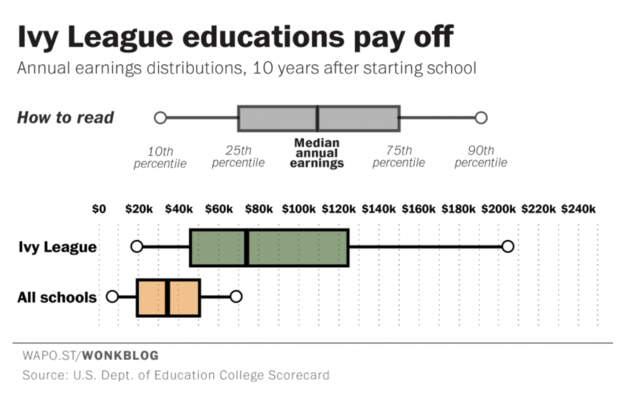

And the answer popped up from a very credible source: the Department of Education itself. They analysed what Ivy League grads and non-Ivy League grads were making 10 years after graduation. Here are their findings: 10 years after starting college, the typical Ivy League grad earns more than twiceas much as the typical graduate of other colleges. In fact, the median Ivy graduate — say, your solid B- Harvard student — is making more money than the top 10 percent of graduates at other schools.

These numbers come from a first-of-its kind data release from the Department of Education. The dataset matches IRS earnings data to higher ed data for the first time, giving us the best possible look at how college graduates are doing financially in the years after they graduate.

Here is the graph, borrowed from the Washington post.

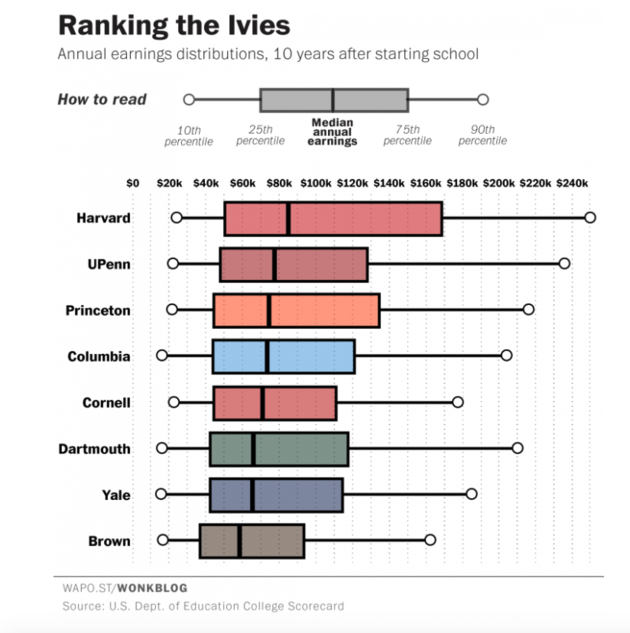

Which school will give you the most bang for the buck? The answer is in the table below.

The right answer is Harvard.

If you still consider taking your child’s test prep lightly and think that it won’t impact your child’s future, we’d like you to think again. I hope this article stirred a bit of doubt in you. Whichever test prep company you choose, make sure you give your child an ability to get the maximum score on the SAT® or ACT. If you’d like to get a FREE test prep consultation with us, schedule one here. No strings attached.